With the global rating agencies raising concerns over the likely impairing of Adani group’s funding access and increase in funding costs, and the group scraping its $600 million bond offering following the bribery charges in the US, all eyes are back on the Gautam Adani-led group’s debt levels.

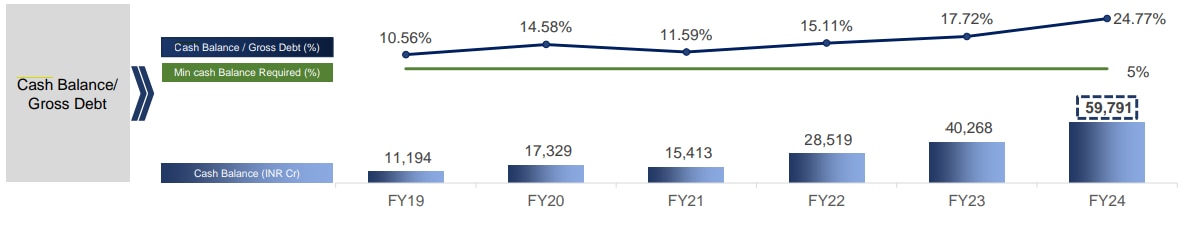

Adanis had a gross debt of Rs 2,41,394 crore and a net debt of Rs 1,81,604 crore at the end of last fiscal. These gross and net debt levels almost doubled since FY19 from Rs 1,05,964 crore and Rs 94,770 crore, respectively. But cash levels for the Adani group also grew five times to Rs 59,791 crore from Rs 11,194 crore in FY19.

With this, the cash balance at FY24 end stood at 24.77 per cent of the group’s gross debt against 10.56 per cent in FY19. The cash to gross debt has been rising steadily after briefly falling in FY21, the group’s FY24 credit summary report suggested.

The report suggested that the group’s cash balances were sufficient to provide a liquidity cover of over 30 months of debt servicing.

Another metric suggested the Adani group’s net debt to Ebitda, which hints at the years a group/corporate would take to pay back its debt if net debt and Ebitda are held constant — has fallen to 2.19 times in FY24 from 3.27 times at the time of FY23, the year that saw Hindenburg crisis unfolding. In FY19, net debt to Ebitda stood at 3.81 times.

Gross assets to net debt has been rising every year since FY19. It stood at 2.63 times in FY24 from 1.67 times in FY19.

Rating agencies said S&P the group may need regular access to both equity and debt markets, given its large growth plans, in addition to its regular refinancing.

“We believe domestic, as well as some international banks and bond market investors, look at Adani entities as a group, and could set group limits on their exposure. This may affect the funding of rated entities,” S&P said.

It, however, noted that its rated entities have no immediate and lumpy debt maturities.

If allegations of illegal activities or misleading statements prove true, S&P said it would assess the group’s governance more negatively.

Moody’s said the indictment of Adani Group’s chairman and other senior officials on bribery charges is credit negative for the group’s companies.