Oil prices are stabilizing after a week of concerns. Supply worries from Middle East conflicts have eased, but China’s manufacturing slowdown and a potential U.S. labor market shift add uncertainty. Geopolitical tensions in the Middle East remain a focus, and Saudi Arabia is expected to continue its voluntary oil-output cut.

LONDON – Oil prices showed minimal movement on Friday, marking a second consecutive week of decline. Concerns related to supply, driven by Middle East conflicts, have abated. Meanwhile, questions persist regarding the demand outlook from China, the world’s largest crude oil importer.

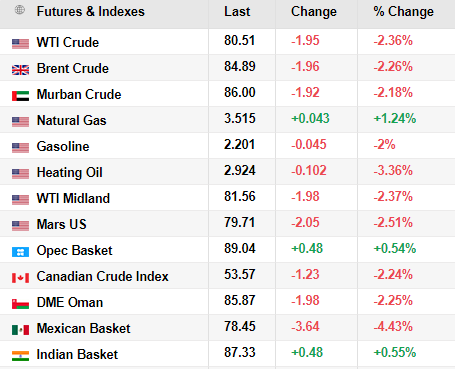

Oil Prices

Brent crude futures edged down by 13 cents, equivalent to a 0.1 percent decrease, settling at $86.72 per barrel at 0955 GMT. Concurrently, U.S. West Texas Intermediate crude futures experienced a 10-cent drop, reflecting a 0.1 percent reduction, closing at $82.36 per barrel.

Although both benchmarks achieved a gain of more than $2 per barrel on Thursday, they are on track to incur a loss of about 4 percent for the week.

An unexpected decline in China’s manufacturing activity in October raised concerns. Official data from the National Bureau of Statistics indicated that the purchasing managers’ index (PMI) dropped from 50.2 to 49.5, falling below the 50-point threshold that separates expansion from contraction.

A private sector survey on Friday indicated that China’s services sector expanded at a slightly faster pace in October. However, sales growth was the slowest in 10 months, and employment stagnated as business confidence waned.

Furthermore, a report from the U.S. Labor Department, expected later on Friday, is anticipated to show a gradual easing of labor market conditions. The report suggests that annual wage growth is at its lowest in nearly 2.5 years, and there has been a significant increase in the supply of workers. These factors may support the view that the U.S. Federal Reserve does not need to further raise interest rates.

The Federal Reserve maintained stable interest rates on Wednesday, while the Bank of England retained rates at a 15-year peak. These unwavering policies contributed to oil price stability as some risk appetite returned to the markets.

Geopolitical tensions remained in focus as Israeli forces encircled Gaza City on Thursday in their offensive against Hamas. The Palestinian terrorist group resisted the assault with hit-and-run tactics from underground tunnels.

City Index analyst Fiona Cincotta stated, “The oil market will be monitoring the situation for a potential escalation of tensions, especially on the Lebanese border, as Hezbollah attacks intensify.”

Hezbollah leader Sayyed Hassan Nasrallah is set to make his first public remarks on Friday since the start of hostilities between Hamas and Israel. His speech will be closely scrutinized for insights into how the group’s role in the conflict might evolve.

On the supply front, Saudi Arabia, the leading oil exporter, is expected to reaffirm an extension of its voluntary cut in oil output by 1 million barrels per day through December, based on analyst expectations.