BNP Paribas’s BFSI research marketing trip through Singapore and Hong Kong last week a few

threw surprises. It said large private banks back are in focus and HDFC Bank as an idea perhaps saw the biggest change in receptivity among investors since its last visit. Investors mostly agreed with Q4FY25 surprise candidates – with the exception of SBI, it said. The foreign brokerage noted that the banking management commentary on credit growth will be watched closely to evaluate the growth acceleration.

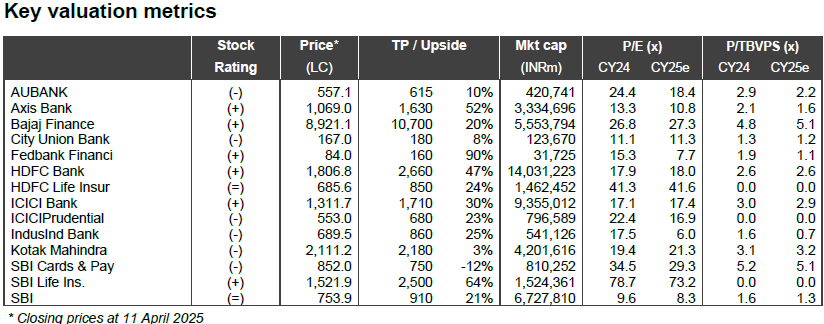

“There was a significant reduction in pushback on the case for India financials, versus the mood at the end of last year, especially large-cap private bank favourites. BNP Paribas sees 90 per cent upside on Fedbank Financial Services, 64 per cent on SBI Life, 52 per cent on Axis Bank, 47 per cent on HDFC Bank and 25 per cent on IndusInd Bank.

Investors, BNP Paribas said, felt that most asset classes — even gold and treasuries, are likely to be extremely correlated in the near term and vulnerable to news-flow shocks. But they believe recent developments do impact India less than many peers and a domestic-oriented sector like financials even more so, making it a viable outperformance candidate, BNP Paribas said.

“Most investors agreed that RBI backstopping the liquidity impact of foreign capital outflows remains the North Star to look up for guidance from the well of worry that they find themselves in. Opinion was slightly more divided on our contention that this inspires c13% credit growth for the system in FY26, which appears to be 100-150bps higher than consensus,” BNP Paribas said.

The brokerage said its counter-consensus perspective in preferring large banks over NBFCs through a rate cut also found purchase as did its reasoning on why current account (CA) balances should stage a recovery now.

“While investors did agree to a bank margin tailwind post 1QFY25, queries around possibility/impact of more CY25 cuts were discussed too. We found minimal pushback to our thesis of earnings growth bottoming in 4QFY25,” it said.