New Delhi: The ratio of non-performing assets across banks in India fell to at least a 13-year low of 2.5 percent in September 2024, the latest Reserve Bank of India (RBI) data shows.

Notably, this strong performance has not solely been driven by write-offs of these loans, though that has been one of the main reasons. There has also been a substantial slowdown in the addition of fresh bad loans.

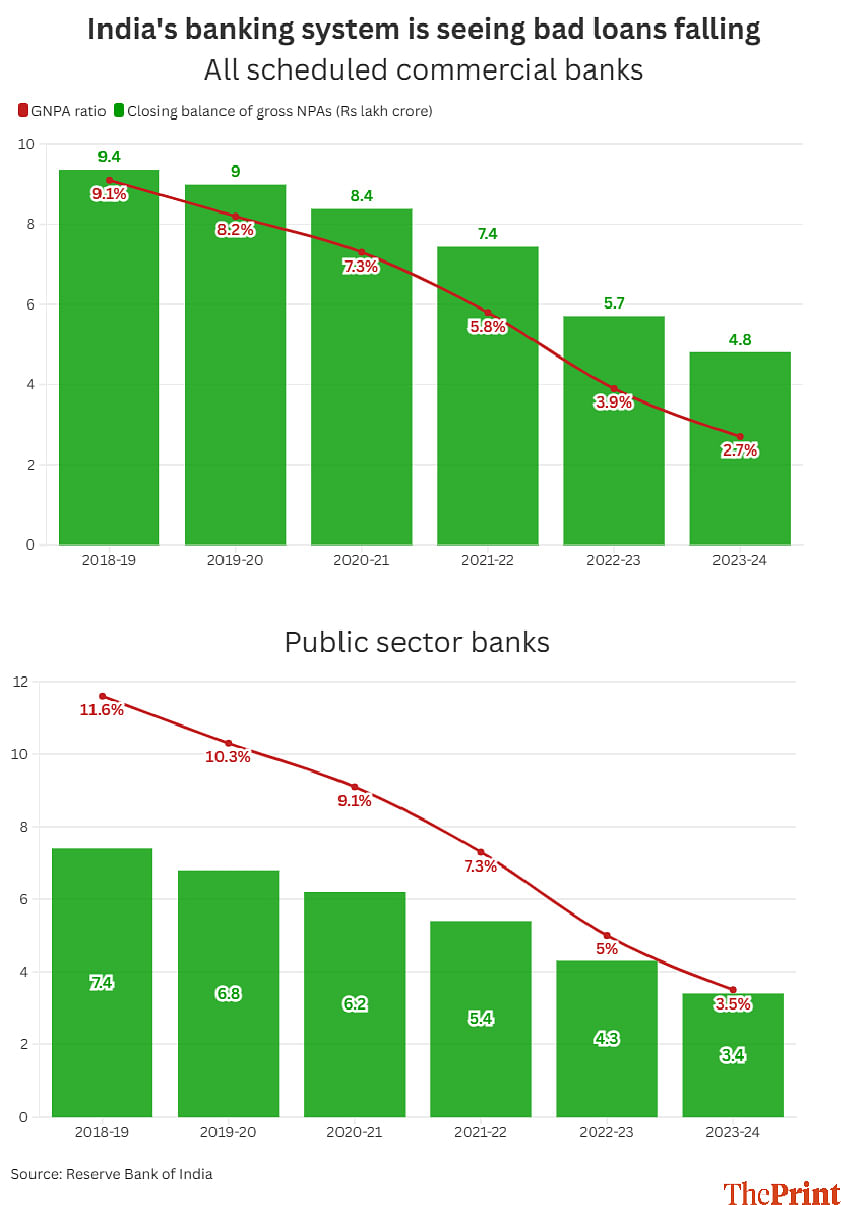

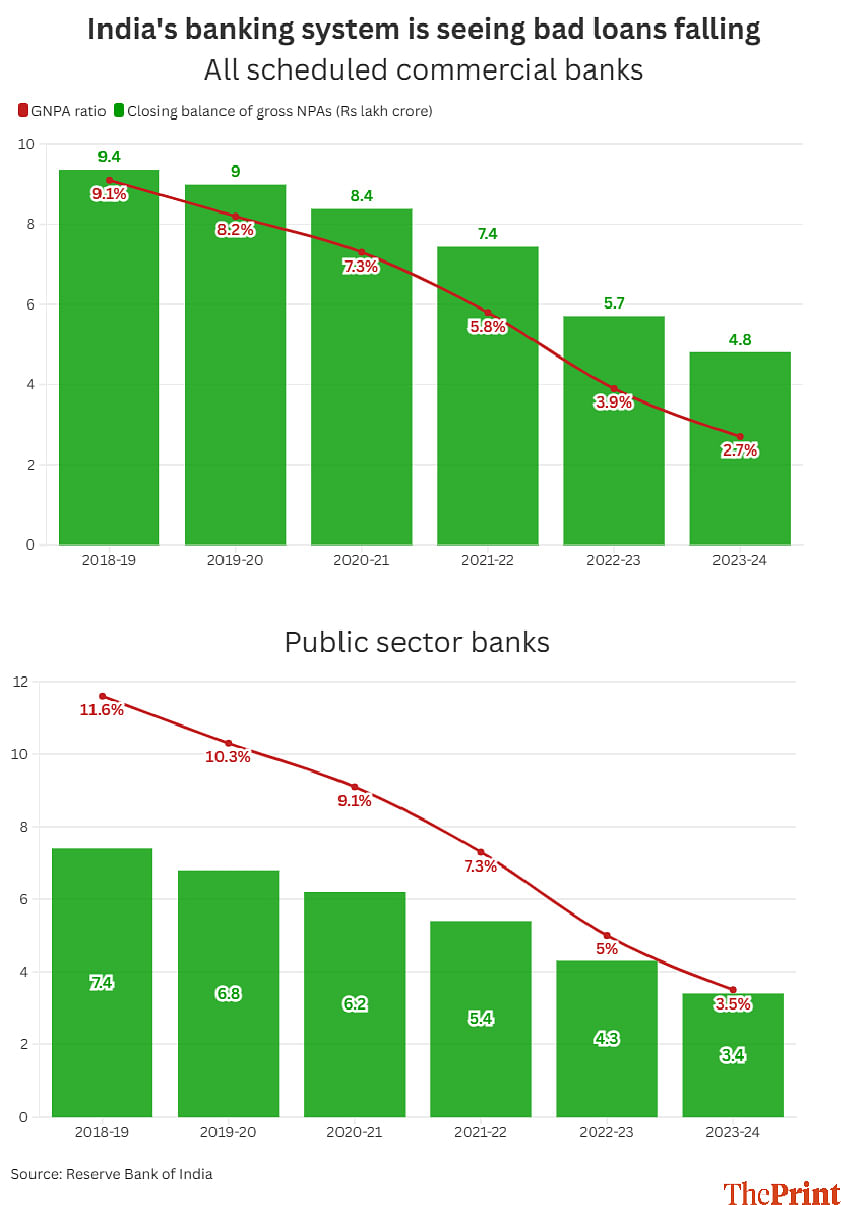

Since then, the gross NPA levels — in absolute terms and as a percentage of total loans given out — have steadily fallen. For instance, gross NPAs of all scheduled commercial banks by 2019 March-end stood at Rs 9.4 lakh crore, amounting to 9.1 percent of outstanding loans.

This fell to Rs 4.8 lakh crore and 2.7 percent — a 13-year-low — by 2024 March-end. The RBI report says the preliminary data shows the ratio would have fallen further to 2.5 percent by 2024 September-end.

Similarly, for public sector banks, the gross NPA level fell from an absolute value of Rs 7.4 lakh crore and a ratio of 11.6 percent in 2018-19 to Rs 3.4 lakh crore or 3.5 percent in 2023-24.

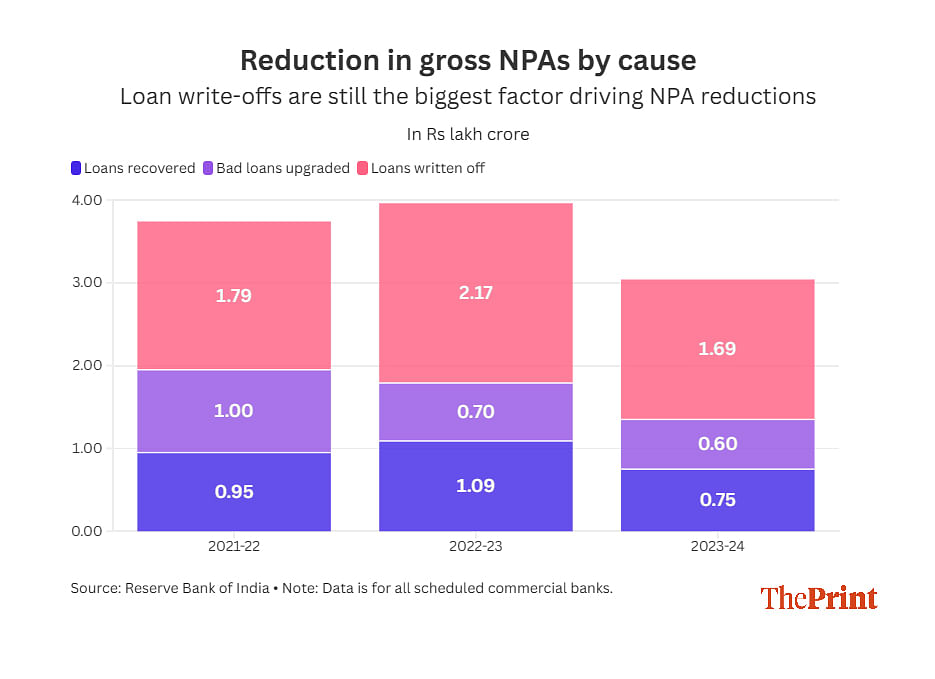

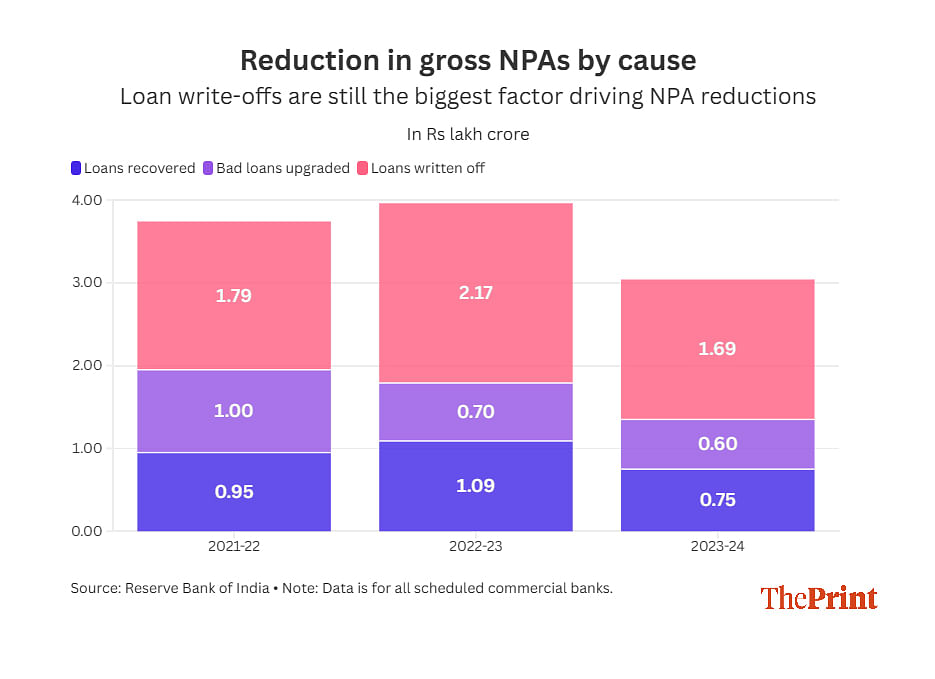

The RBI’s reports have been providing a reason-wise breakup of the reduction in NPA levels since 2021-22. The data shows that the single-largest reason for reductions in NPAs since that time has been because of loan write-offs.

A loan write-off is a technical requirement under which banks, after they have made adequate provisions, take the bad loan off their assets side of the balance sheet, reporting the amount instead as a loss. The recovery process of the bad loan continues, unlike with a loan waiver, under which banks cancel out the entire loan amount.

The RBI data shows that of the Rs 3.75 lakh crore reduction in gross NPAs across scheduled commercial banks in 2021-22, Rs 1.79 lakh crore or 48 percent was due to loan write-offs. This share rose to nearly 57 percent in 2023-24.

The rest of the reduction was due to recoveries or upgradation of NPAs to performing assets as their repayment cycle restarted.

Among the public sector banks, the share of write-offs in the overall reduction of gross NPAs increased from 56 percent in 2021-22 to 65 percent in 2023-24.

Also Read: 7 months into FY25, govt has met just 42% of capex target, low GDP growth puts strain on fiscal goals

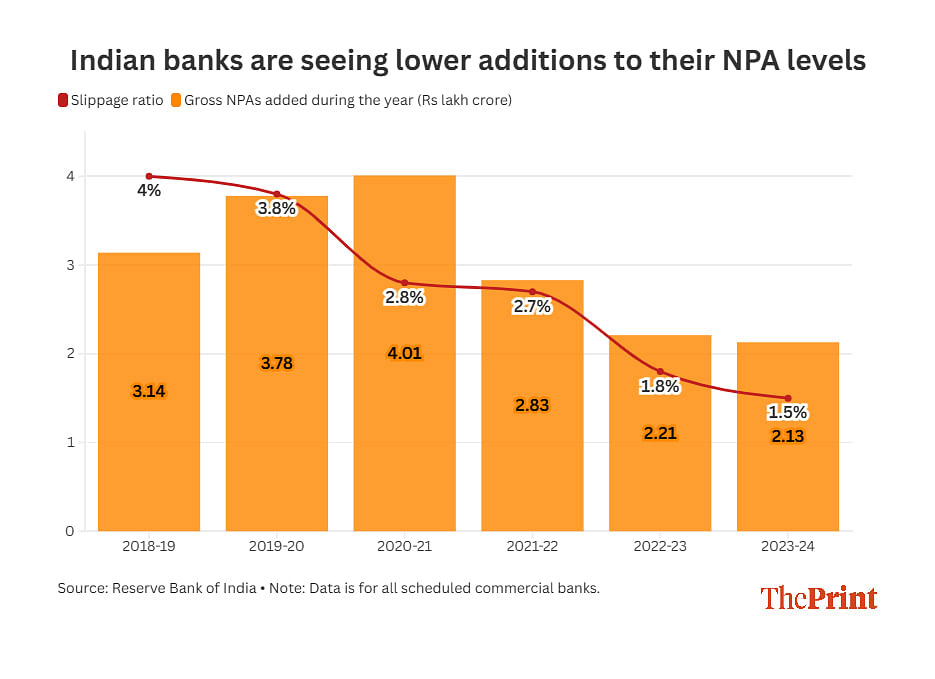

While write-offs remain a significant reason for the reduction in the NPA levels of banks, the data shows that the other major factor driving the trend is that fewer amounts of loans have been turning bad lately in absolute terms, as well as a percentage of total loans outstanding.

The overall banking sector in 2018-19 added bad loans amounting to Rs 3.14 lakh crore, which increased to Rs 4.01 lakh crore in 2020-21, the pandemic year. Since then, this figure has steadily been falling till it reached Rs 2.13 lakh crore in 2023-24.

The RBI also provides data on the slippage ratio, that is, fresh bad loans as a percentage of the total loans outstanding at the beginning of that year. The lower this ratio, the better it is for the banking sector.

The slippage ratio has consistently fallen since 2018-19 — from 4 percent that year to 1.5 percent in 2023-24. The RBI further notes that in this regard, public sector banks have outperformed their private sector peers.

“For the third consecutive year, the slippage ratio of private banks remained higher than public sector banks on account of the former’s larger fresh accretion to NPAs,” the RBI report notes.

(Edited by Madhurita Goswami)

Also Read: India is speeding towards 4th largest economy spot, but global & domestic challenges await in 2025