New Delhi: Income tax from individuals now comprises more than 30 percent of the government’s total tax receipts, significantly exceeding the contribution of taxes paid by companies, new data from the Income Tax Department shows.

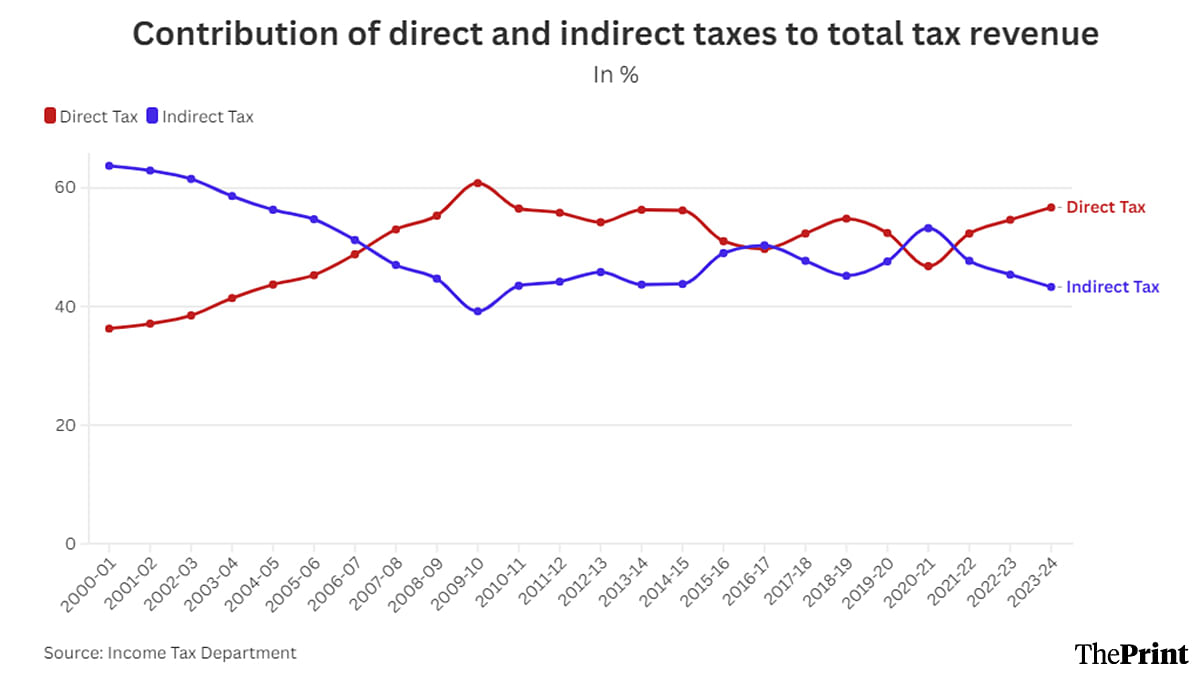

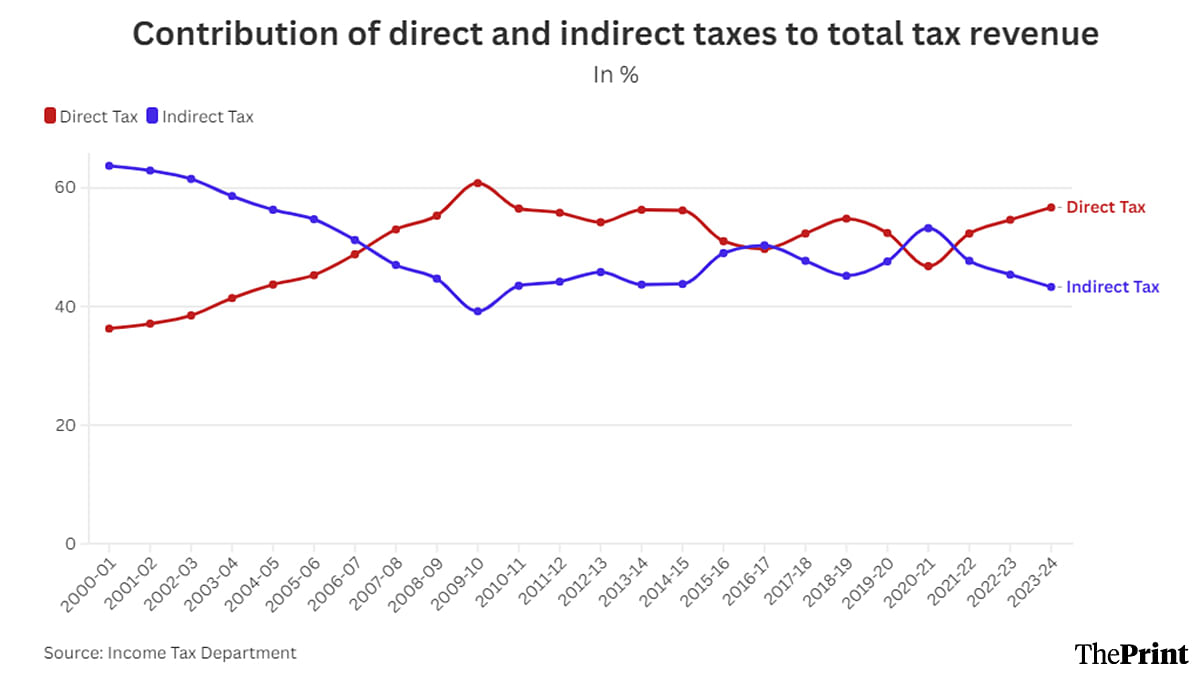

The data, made public by the I-T department Thursday for the period 2000-01 to 2023-24, shows that the government is increasingly reliant upon direct taxes—a combination of personal income tax, corporate tax and a small segment called other taxes—rather than indirect taxes, such as the Goods and Services Tax, excise duties and customs duties.

The findings have a bearing on the efficacy of tax policy aspects, such as how progressive it is and whether tax rate cuts have helped.

Also Read: Individuals, businesses are increasingly defaulting on microloans. Both lenders & borrowers at fault

Direct taxes made up 56.7 percent of total tax collections in 2023-24, a continuation of its rising share since 2021-22. This is the highest it has been since 2009-10.

In tax policy, higher reliance on direct taxes, which are pegged to income levels and profitability, is considered a more progressive approach than an over-reliance on indirect taxes, which apply to everyone the same, regardless of income levels.

In developed economies, the share of direct taxes far exceeds that of indirect taxes. In the US, for example, corporate tax, income tax, and social security and medicare taxes together make up about 90 percent of the total tax revenue. In the OECD (Organisation for Economic Co-operation and Development) countries, the proportion of direct taxes is about 60-65 percent.

This element of taxation comes out clearly when looking at the year 2020-21, which was heavily impacted by the COVID-19 pandemic. That year, the contribution of indirect taxes surpassed that of direct taxes—one of such rare instances in the last 15 years or so. This was because the pandemic impacted individual incomes and profits of companies, leading to lower direct tax collections.

Despite that, purchases still had to be made, which pushed up the share of indirect taxes. The balance between the two reverted to normal the next year as incomes and profits rebounded.

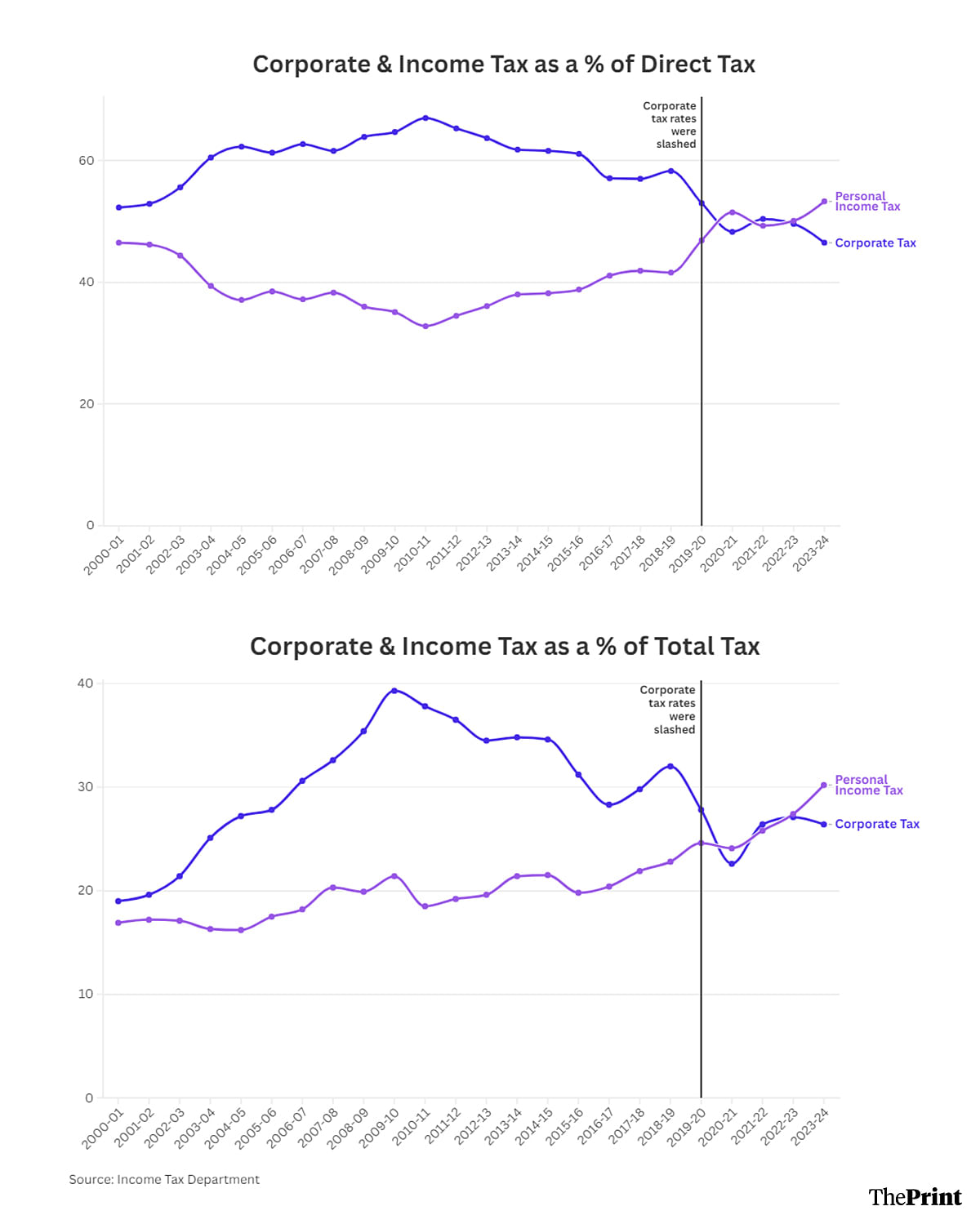

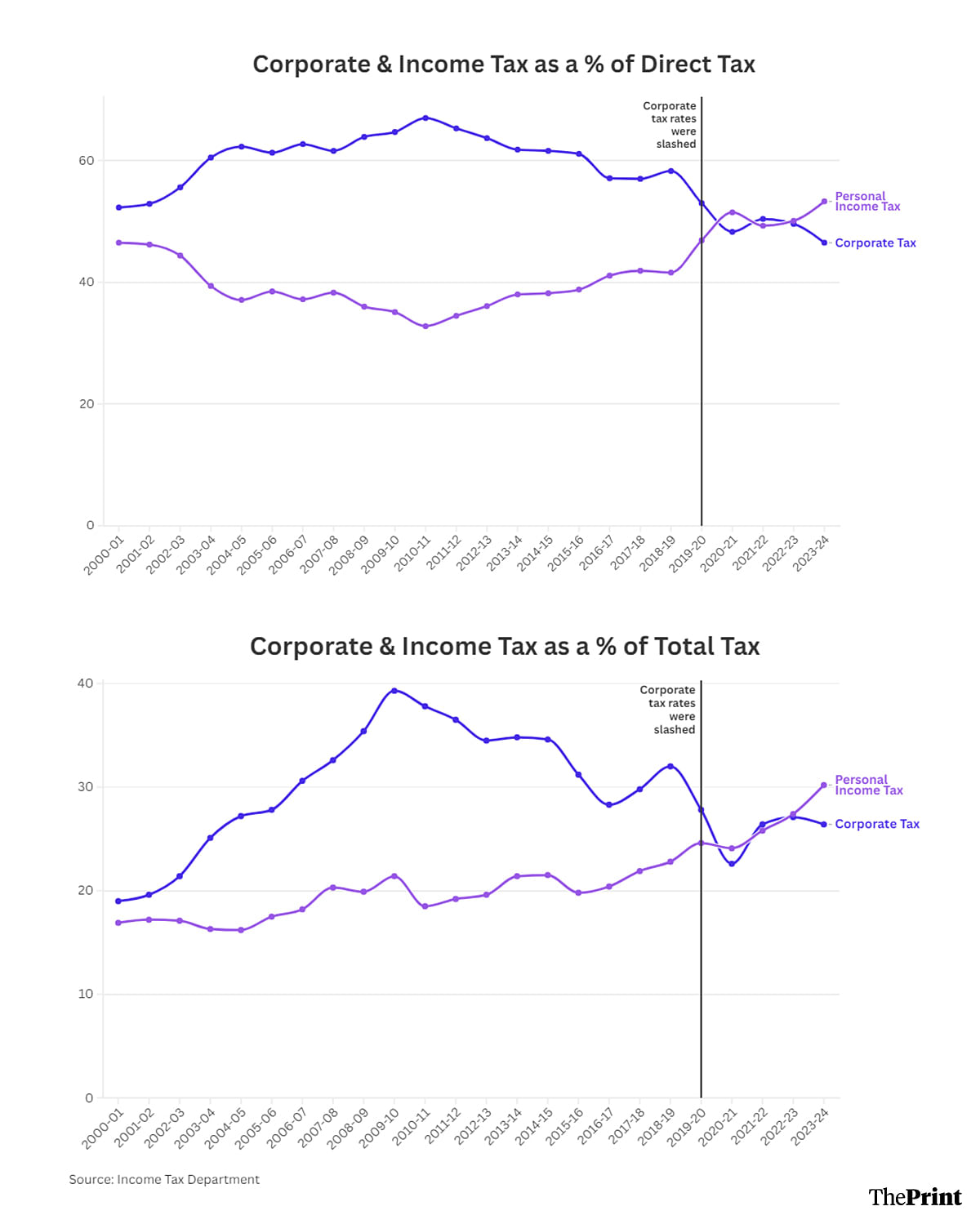

However, the data also shows that the increased reliance on direct taxes is actually being driven by an increased reliance on the taxes paid by individuals rather than companies.

Personal income tax made up 53.3 percent of direct taxes in 2023-24, the highest it has been in the 24 years for which there is data. The share of personal income tax in direct taxes crossed the 50 percent mark—signifying higher reliance on it rather than on corporate taxes—for the first time in 2020-21.

Notably, the share of corporate tax collections in direct taxes seems strongly influenced by the government’s 2019 decision to slash corporate tax rates, citing the argument that lower rates would increase investment activity and eventually yield higher taxes.

Corporate tax revenues did grow 64 percent since the rate cut, the data shows, but personal income tax collections grew 112 percent over this period, resulting in a significantly lower share of corporate tax collections in overall direct tax revenue.

Corporate taxes made up 58.3 percent of direct taxes in 2018-19—a year before the rates were cut—sliding to 46.5 percent as of 2023-24.

A combination of these two trends—higher reliance on direct taxes and, within this, a higher reliance on income tax—has meant that India’s overall tax collections are more reliant on taxes paid by individuals than ever before.

That is, the share of personal income tax in total tax collections—counting both direct and indirect tax sources—has risen to 30.2 percent as of 2023-24. This proportion was 16.2 percent in 2004-05 and 21.5 percent in 2014-15.

(Edited by Mannat Chugh)

Also Read: India’s manufacturing workers saw prices rise faster than incomes even as their productivity fell